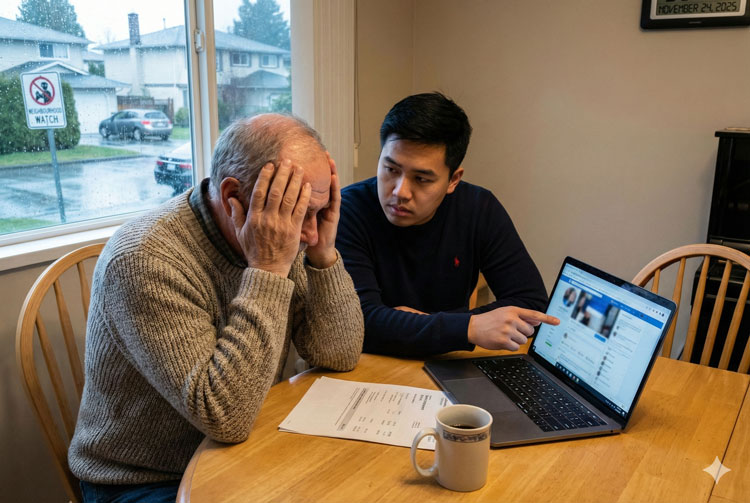

Seniors are getting taken advantage of by people pretending to be their friends A retired Richmond man in his 80s

Fraud Education Resources

In 2020, Canadians lost $165 million to fraud.

By 2024, this number had risen to $644 million lost.

Fraud causes significant harm to Canadian consumers and businesses

EDUCATION is the most effective WEAPON for fighting Fraud

Recognize It.

Reject It.

Canadian Anti-Fraud Centre

Established in January of 1993, the Canadian Anti-Fraud Centre (CAFC) is currently operated by the Royal Canadian Mounted Police (RCMP), in partnership with the Competition Bureau of Canada and the Ontario Provincial Police (OPP).

As Canada’s central repository for data, information and resource material as it relates to fraud, the CAFC commits to providing timely, accurate and useful information to assist citizens, businesses, law enforcement and governments in Canada and around the world.

- Canadian Anti-Fraud Centre impersonation alert!

Fraudsters continue to impersonate Canadian Anti-Fraud Centre (CAFC) representatives. These fraudsters often claim to be investigating fraud or promise to help get your money back from a previous incident. They then request personal and financial information.

Latest Fraud Alerts

Q3-2025 Fraud Report

Executive Summary The third quarter of 2025 was defined by a massive surge in Impersonation Scams and Investment Fraud. Advanced

AI-powered crypto scam is targeting Canadians

Fake ads using AI are luring Canadians into cryptocurrency scams, promising double the returns. Watch video for full details.

Top 10 Scams in Canada (2024)

(Based on Dollar Loss )

Fraud Type

Reports

Victims

Dollar Loss

Hallmarks of Common SCAMS

Deception

Victims are led to believe they are dealing with a legitimate organization (e.g. bank, government, corporation, etc) or a person (family member, friend, lawyer, law enforcement officer, etc.) often in an attempt to gain trust.

Urgency

The frauds often involve creating a sense of urgency to get victims to send money or provide personal information before they realize it is a scam. This includes high pressure tactics to get victims to act now before it is too late.

Victimization

It is a game of numbers; the more people are targeted, the more likely you will be successful. Ultimately, the criminals involved do not discriminate when choosing targets. Certain demographics may be more susceptible to certain scam types and solicitation methods.

Scope

Fraud is often national and international in scope. Most frauds today involve solicitations originating in one country targeting victims in another country with money going to yet a different country.

Loss

Frauds are designed to get intended victims to part with their money or personal information. Individual victim losses can range from hundreds of dollars to hundreds of thousands of dollars, even millions.

Hallmarks of Common SCAMS

Deception

Victims are led to believe they are dealing with a legitimate organization (e.g. bank, government, corporation, etc) or a person (family member, friend, lawyer, law enforcement officer, etc.) often in an attempt to gain trust.

Urgency

The frauds often involve creating a sense of urgency to get victims to send money or provide personal information before they realize it is a scam. This includes high pressure tactics to get victims to act now before it is too late.

Victimization

It is a game of numbers; the more people are targeted, the more likely you will be successful. Ultimately, the criminals involved do not discriminate when choosing targets. Certain demographics may be more susceptible to certain scam types and solicitation methods.

Scope

Fraud is often national and international in scope. Most frauds today involve solicitations originating in one country targeting victims in another country with money going to yet a different country.

Loss

Frauds are designed to get intended victims to part with their money or personal information. Individual victim losses can range from hundreds of dollars to hundreds of thousands of dollars, even millions.

Fraud Terminology

Bank Investigator

Any fraudulent solicitation claiming to be your financial institution advising of fraudulent charges on your account. Request is made to help bait/ catch the fraudsters or to move your money to keep it safe.

Counterfeit Merchandise

Any false, deceptive, misleading and fraudulent advertising of counterfeit name brand products, typically offered at very discounted prices.

Emergency

An urgent request for funds for immediate support, typically from a family member or friend.

Extortion

Any person who unlawfully obtains money, property or services from a person, entity, or institution, through coercion.

Identity Fraud

The unauthorized use of personal information to create a fictitious identity or to assume/takeover an existing identity in order to obtain financial gain, goods or services, or to conceal criminal activities.

Job

Any false, deceptive or misleading solicitation offering employment. The solicitation often requests an advance fee to secure the job or to obtain the materials to perform the job or any job offer involving money transfer or wiring funds related to cashing monetary instruments.

Merchandise

The non-delivery of goods purchased through classified ads over the internet, online auction sites, through a catalogue or by mail order. If product is received, it is of inferior value, quality or it is not what it is supposed to be.

Personal Information

Any solicitation where an individual is asked for or to verify private and personal information, outside of phishing.

Phishing

Any e-mail or text message directing providing a link where they ask to update or provide personal or financial information.

Romance

Any individual with false romantic intentions towards a victim and by gaining their affection and trust gain access the victim’s money, bank account, credit cards or in some cases by getting the victims (usually unknowingly) to commit fraud on their behalf.

Service

Any false, deceptive, or misleading promotion of or solicitations for services. These solicitations involve third parties that commonly make offer for telecommunications, Internet, finance, medical and energy services. Additionally, this category may include but is not limited to offers such as extended warranties, insurance and sales services.

Sextortion

Online extortion and sextortion are evolving with new technologies. Sextortion, or online sexual exploitation, is blackmail. It occurs when someone threatens to send an existing or fabricated sexual image or video of you to other people if you do not pay them or provide more sexual content.

It can also occur when someone is encouraged to participate in or observe online situations of a sexual nature. These encounters can be recorded or captured without the victim’s knowledge. The fraudster then threatens to send the recorded material to friends, family members, or work colleagues if money or additional images are not sent.

Social media can allow fraudsters to develop an understanding of someone’s social circles and enable communication between threat actors and potential victims. Social media platforms are commonly used in sextortion.

Social Engineering

Social engineering is the psychological manipulation of people into performing actions or divulging confidential information. It relies on human errors rather than system flaws to gain unauthorized access to data, systems, or physical locations.

Spear Phishing

A fraudulent solicitation claiming to be from a source (e.g. existing client, account holder, supplier or company executive) known to a business to convince them to send them money.

Educational Videos

Investment Scam

2024 Losses: $361 Million

An “Investment Scam” is a fraudulent scheme that tricks individuals into parting with money under the guise of a profitable investment opportunity.

Scammers promise unrealistically high returns with little to no risk, often using high-pressure tactics to force a quick decision. Common types include Ponzi schemes, where returns are paid using new investors’ funds, and “pump-and-dump” schemes that artificially inflate an asset’s price before the scammer sells.

These fraudsters frequently use fake websites, social media, and celebrity endorsements to appear legitimate, ultimately stealing the invested capital. Always verify an investment’s legitimacy and the seller’s registration.

Spear Phishing Scam

2024 Losses: $67.2 Million

A “Spear Phishing Scam” is a highly personalized cyberattack that targets a specific individual or organization. Unlike generic phishing sent in bulk, spear phishers conduct extensive research—often on social media—to craft a message that appears to come from a trusted colleague, superior, or vendor.

The message is tailored with personal details to be highly convincing (e.g., “Hi [Name], can you urgently pay this invoice for the [Project Name]?”). The goal is to trick the victim into wiring money (Business Email Compromise) or clicking a link to steal corporate credentials or install malware.

Due to its personalization, it has a high success rate.

Romance Scam

2024 Losses: $58.7 Million

A “Romance Scam,” also known as “catfishing” or a “sweetheart scam,” is a financial crime where the fraudster creates a fake online identity to build a seemingly loving relationship with a victim.

These criminals spend weeks or months cultivating deep trust on dating apps or social media, often using elaborate stories and stolen photos. Once the emotional connection is established, the scammer manufactures an urgent crisis—such as a medical emergency, a sudden financial disaster, or a need for travel money to finally meet—and asks the victim to wire money.

The relationship is completely fake, and the sole goal is to exploit the victim’s love for money.

Job Scam

2024 Losses: $47.1 Million

A “Job Scam,” or employment fraud, is a scheme where a criminal poses as a legitimate employer or recruiter to trick job seekers.

Scammers post fake, highly appealing job opportunities—often work-from-home—with suspiciously high salaries and minimal requirements. Their goal is to steal money or personal information. They typically ask the victim to pay an upfront fee for “training” or “equipment,” or they send a fraudulent check and ask the victim to wire a portion back.

They may also conduct interviews via text/chat, a major red flag that the offer is fake and designed to steal identity or funds. Legitimate employers never ask a new hire to pay money.

Extortion Scam

2024 Losses: $19.8 Million

An “Extortion Scam” involves a criminal threatening a victim with harmful action unless they comply with a demand, typically for money or cryptocurrency.

The most common online version is a “Sextortion” scam, where the fraudster falsely claims to have compromising photos or videos of the victim (often obtained through hacking or social engineering) and threatens to release them to family and friends.

Other forms include ransomware, where a victim’s files are encrypted until a payment is made, or threats of arrest, legal action, or physical harm if a supposed debt is not paid immediately. The core tactic is creating fear to coerce an urgent, usually irreversible, payment.

Service Scam

2024 Losses: $16.3 Million

A “Service Scam” involves a fraudster offering a service—often unsolicited—to steal money or personal information, or to provide substandard/unnecessary work.

Examples include tech support scams, where criminals falsely claim your computer is infected to gain remote access and demand payment, or home service scams, where contractors take pre-payment but never complete the job, or perform poor-quality, damaging work.

Scammers often use pressure tactics, impersonate legitimate companies (like your phone or internet provider), or advertise “too-good-to-be-true” deals to deceive victims.

Bank Investigator Scam

2024 Losses: $16.3 Million

The “Bank Investigator Scam” involves a fraudster impersonating a bank employee, police officer, or bank examiner to trick a victim into “assisting” with a phony investigation into dishonest bank staff.

The scammer usually contacts the victim, often via a spoofed phone number, and claims that their account is compromised. They then persuade the victim to withdraw a large sum of cash, transfer money, or hand over their debit/credit card and PIN as “evidence” for a secret operation.

The fraudster disappears with the money and the victim is never reimbursed.

Recovery Pitch Scam

2024 Losses: $9.1 Million

A “Recovery Pitch Scam,” also known as a “Double Dip Scam,” targets individuals who have previously lost money to fraud.

Scammers, often using “sucker lists” of past victims, contact them claiming to be law enforcement, a lawyer, or an asset recovery specialist. They promise to recover the lost funds or offer an exclusive new investment to recoup losses.

The catch is they require an advance fee for their “services,” which may be called a tax, administrative charge, or retainer. Once the victim pays, the scammer disappears, leaving the person victimized a second time with no funds recovered.

Merchandise Scam

2024 Losses: $9.1 Million

A “Merchandise Scam” is a deceptive scheme centered on the buying and selling of goods, typically online.

The most common variation involves a fraudulent seller who advertises a desirable item—often at a suspiciously low price—collects the buyer’s payment, and then either sends nothing at all (non-delivery) or ships a cheap, counterfeit, or inferior product.

Another common type is the overpayment scam, where a buyer sends a seller a fake check for more than the item’s price and asks the seller to wire back the difference before the fraudulent check bounces.

Vendor Scam

2024 Losses: $8.2 Million

A “Vendor Fraud” scam targets individuals or businesses selling goods online. The scammer pretends to be an out-of-town buyer, agreeing to purchase an item unseen.

When it’s time to pay, they use several tactics to steal the merchandise or more money. Common methods include sending **spoofed payment notifications** that falsely claim funds are pending until the seller ships the item, or using the **overpayment tactic**, where they send a fraudulent payment for more than the asking price and ask the seller to immediately wire the excess back.

The goal is to obtain the goods or an untraceable cash refund before the seller realizes the payment was fake.

How to Protect Yourself Against Fraud

Fraud Prevention Checklist

Below are a few questions to ask yourself every time you are contacted for personal information.

If any of the following apply, DO NOT provide your information. Seek further advice from trusted resources.

- Is the call unsolicited? Was it expected or out of the blue?

- Is the matter urgent? Does it require immediate action?

- Are they threatening legal action?

- Are they asking you to confirm personal information such as your name, address, or account details?

- Are they looking for a fast or instant response?

- Are they asking you for money?

- Is the caller avoiding using the actual name of the company or financial institution?

- Are they offering you a prize, free gift, refund or trial?

- Are they claiming to be the police or investigating something?

- Does the email have an odd email address?

- Is the formatting strange?

- Are there spelling mistakes?

- Are you being asked to change your password despite not sending a request to do so?

Appoint a Trusted Contact Person

The Trusted Contact Person initiative is part of regulatory measures to support advisors in their efforts to help protect investors and their financial interests.

Canadian seniors are increasingly called upon to make complex financial decisions, with higher stakes, later in life than ever before. For many, health or cognitive changes that can occur with age, may affect their ability to make these decisions. This can make seniors more susceptible to financial exploitation and fraud.

Get CyberSafe

Get Cyber Safe is a national public awareness campaign created to inform Canadians about cyber security and the simple steps they can take to protect themselves online.